Withholding Tax Credit Inquiry Instructions

- Accessing the Business Tax Online Credit Inquiry System

- General Instructions

- Error Messages

- Contact Information

Accessing the Business Tax Online Credit Inquiry System

Click here to access the Business Tax Online Credit Inquiry System.

General Instructions

If there are current credits on your withholding tax account, this site will allow you to view and print your own credit balance. You can use this credit on your next withholding tax return filed with the Department.

Overpayments displayed on the Online Credit Inquiry System are based on the most recent business day's processing. For instance, if you are accessing this system on a Tuesday, information displayed will generally reflect the Department's Monday processing.

- Withholding tax credits cannot be used towards sales/use taxes or any other taxes.

You will need your business’ Missouri Tax Identification Number and tax filing PIN Number.

- Your identification number is the 8 digit number issued to you by the Missouri Department of Revenue to file your business taxes. It can be found on any correspondence sent by the Department of Revenue, including your sales tax license if you make retail sales.

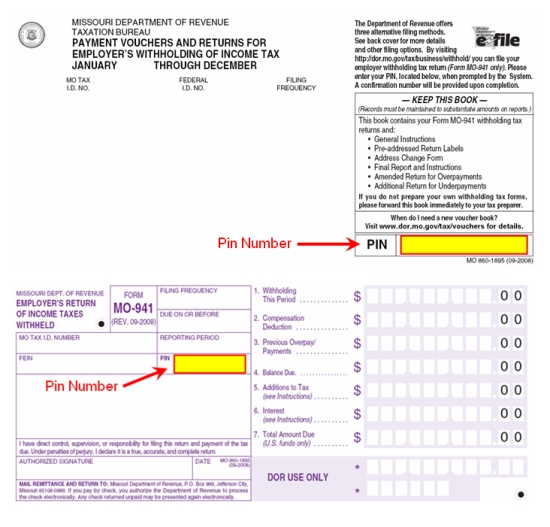

- Your PIN is a 4 digit number located on the cover of your voucher booklet or return.

You Are Ready to Make Your Inquiry

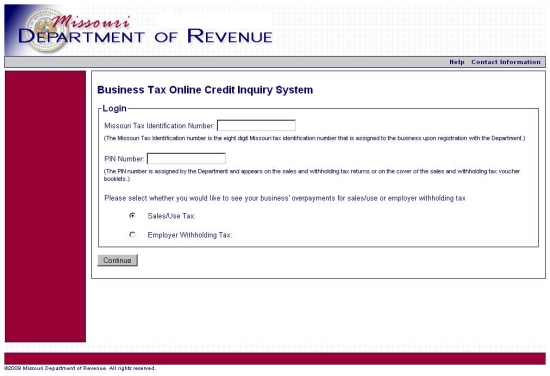

Step 1: Enter your Missouri Tax Identification Number and PIN. The Department of Revenue has assigned the PIN number which can be found on the cover of your return or voucher booklet.

If you have not entered the correct Missouri Tax Identification Number or PIN you will receive the following message:

- Invalid login. Please re-enter your login and password.

If you have entered an invalid Missouri Tax Identification Number, you will receive the following message:

- The Missouri Tax Identification Number you entered is an invalid number. Please re-enter the number.

If you do not know your Missouri Tax Identification Number or PIN, contact the Department of Revenue at (573) 751-3505. Please note this information is considered confidential and will only be provided to a listed officer or Power of Attorney.

Step 2: Select the tax type, sales tax or withholding tax, for which you are seeking credit information.

If the business is not registered for the tax type selected, you will receive the following message:

- This business is not registered for Missouri employer withholding tax. For assistance, please contact the Taxation Division at (573) 751-5860.

Step 3: Click "Continue".

If You Have Credits on Your Account

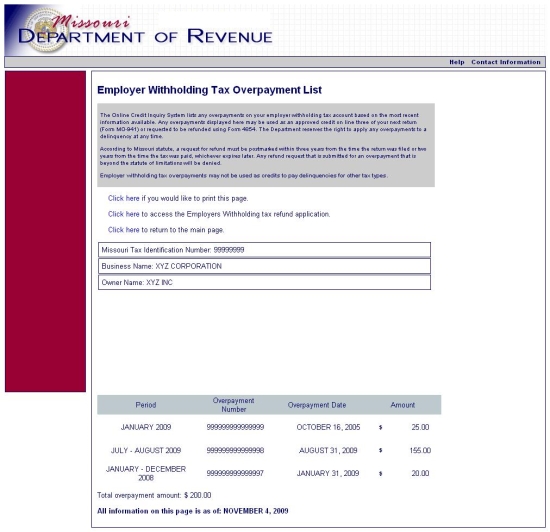

If you have current overpayments on your account for the tax type selected, Online Business Tax Credit Inquiry System will list each overpayment.

For each overpayment, Online Business Tax Credit Inquiry System will present the following information:

- Period - This column lists the amount of the overpayment.

- Overpayment Number - This column lists the number assigned to the payment by the Department.

- Overpayment Date - This column lists the date of the overpayment. This date will be the postmark date of the original payment. You will have three years from the time the return was filed or two years from the time the tax was paid, whichever expires later, to use the credit on a future return (Form MO941) or submit a refund request to the Department.

- Amount - This column lists the amount of the overpayment.

- Total overpayment amount - The Online Business Tax Credit Inquiry System will total all overpayments listed on the page.

This page will also present you with the following three options:

- Click here if you would like to print this page - You have the option of printing the page for your records.

-

Click here to access the Employer’s Withholding Tax refund application - This link will take you to the Employer Withholding Tax Refund Application (Form 4854). This form is fillable and you will have to

submit a separate application for each overpayment listed on the Online Business Tax Credit Inquiry System. Submit this application to the Department at:

Missouri Department of Revenue

P.O. Box 3375

Jefferson City, MO 65105-3375

- Click here to return to the main page - This will take you back to the Login Page.

If No Credits are on Your Account

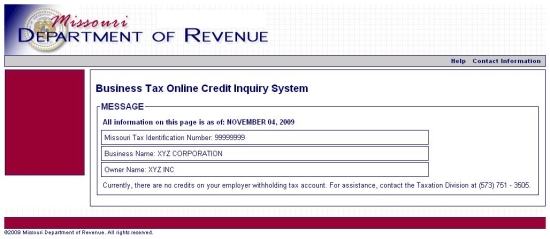

If you have no overpayments on your account for the tax type you selected, Business Tax Online Credit Inquiry System will present a message page.

You will receive the following message. This message will always direct the business to contact the Department of Revenue so that a customer service representative can answer the customer’s questions.

- Currently, there are no credits on your withholding tax account. For assistance, please contact the Taxation Division at (573) 751-3505.

Error Messages

The following message will be presented if you cannot access the Online Credit System. The taxpayer must speak to the Department of Revenue in order to resolve any issues before they can access the Online Credit System.For assistance, you can contact the Taxation Division at (573) 751-3505.

- The Missouri Tax Identification Number you entered is an invalid number. Please re-enter the number.

- PIN does not match Missouri Tax Identification Number. Please re-enter the PIN.

Contact Information

If you have further questions, please contact us:

Missouri Department of Revenue

Taxation Division

P.O. Box 3375

Jefferson City, MO 65105-3375

Fax: (573) 522-6816

Telephone: (573) 751-3505

E-mail: withhold@dor.mo.gov