Motor Fuel Tax

Chapter 142, RSMo: Missouri receives fuel tax on gallons of motor fuel (gasoline, diesel fuel, kerosene, and blended fuel) from licensed suppliers on a monthly basis. The tax is passed on to the ultimate consumer purchasing fuel at retail. The tax is distributed to the Missouri Department of Transportation, Missouri cities and Missouri counties for road construction and maintenance. There are about 700 licensees, including suppliers, distributors, transporters and terminal operators. Consumers may apply for a refund of the fuel tax when fuel is used in an exempt manner See the Motor Fuel FAQs for more information.

The tax rates are outlined in the below table.

Forms and Publications

- Fuel Tax Forms

- Monthly Highway Reports

- Motor Fuel Tax Non-Highway Form Updates

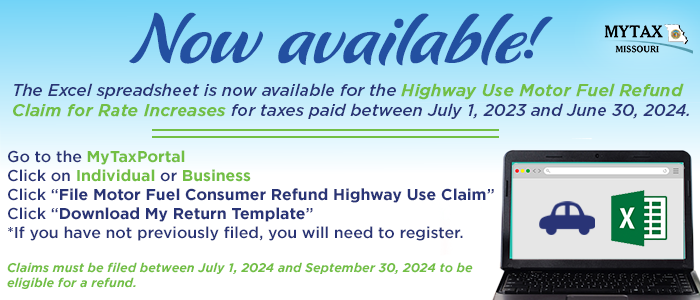

- Highway Use Motor Fuel Refund Claim for Rate Increases Form

Fuel Tax Rates

Licensees

Laws & Regulations

Other Useful Sites

- Motor Carrier 1-Stop

- International Fuel Tax Agreement (IFTA)

- Find IRS Terminal Control Numbers (TCN)

Contact Information

Bulletins & FAQs

- Petroleum Inspection Fee Increase

- Rate Increase Motor Fuel Transport Fee Bulletin

- 2021 Motor Fuel Tax Increase FAQs

- File Motor Fuel Tax Increase Refund Claim Online

- Rate Increase Motor Fuel Bulletin

- Increase in Pool Bond Fee Bulletin

- Tax Requirements of Clear & Dyed Motor Fuel

- 2022 Motor Fuel Report Dates

- 2023 Motor Fuel Report Dates

- 2024 Motor Fuel Report Dates

- Motor Fuel Tax Frequently Asked Questions