Unemployment Tax Relief FAQs

FAQs for the American Rescue Plan Act of 2021

Yes, Missouri will follow the American Rescue Plan Act of 2021 for the exclusion of a maximum of $10,200 ($20,400 for married couples) of unemployment compensation from their federal adjusted gross income. By allowing this exclusion from the federal adjusted gross income, both the federal government and the state of Missouri are ensuring this portion of unemployment compensation will not be subject to income tax. Only those individuals that had a federal adjusted gross income of less than $150,000 qualify for the exclusion on their federal return. The same income threshold applies on the Missouri return.

If you previously filed your Missouri 2020 return and reported unemployment income that may now be excluded from your federal adjusted gross income, you must file an amended Missouri return to reflect the reduction to your federal adjusted gross income and federal tax deduction, if applicable. Missouri is one of a handful of states that allows you to take a state deduction on what you paid in taxes (less certain credits) to the federal government. If you don’t calculate this new, lower federal tax deduction, you could owe more for your state tax and receive a bill including penalties and interest from us later.

Yes, you must include all income received from unemployment compensation on your Property Tax Credit Claim. See instructions below.

- Form MO-PTS

- Include the taxable portion of unemployment compensation on MO-PTS, Line 1; since it is included in the Missouri Adjusted Gross Income (MO-PTS, Line 1).

- Report the exempt portion of unemployment income, not already included in MO-PTS, Line 1, on MO-PTS, Line 3.

- Form MO-PTC

- Report the total unemployment compensation received on MO-PTC, Line 2.

There are many variables that may affect the Missouri return, and we do not want to presume that there is a blanket solution for everyone.

To calculate your federal adjusted gross income and federal tax deduction to report on your amended Missouri return, you may need to mock up a federal amended return. This should mirror the federal adjusted gross income and federal tax achieved after the Internal Revenue Service made the adjustments related to unemployment benefits. If you file an amended federal income tax return to claim additional federal credits, you should use that amended federal return in preparation of your amended Missouri return.

If you qualified for this relief, your federal adjusted gross income will decrease along with your federal tax deduction. If you pay tax in another state or were a part-year resident in Missouri, it may also impact the calculation for your credit for tax paid to another state (Form MO-CR) or your Missouri income percentage (Form MO-NRI). It may also impact the amount of non-refundable tax credits you may claim (Form MO-TC).

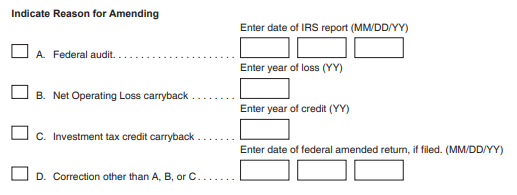

On the 2020 Form MO-1040, Page 4, select Box D. Correction other than A, B, or C. Enter the date of your federal adjustments, the postmark date of your federal amended return, or the postmark date of your Missouri amended return.

If you still have questions, please check out other Individual Income Tax FAQs.