Boat/Vessel Titling and Registration - Additional Information

MO Numbers

- serves same function as a motor vehicle's license plate;

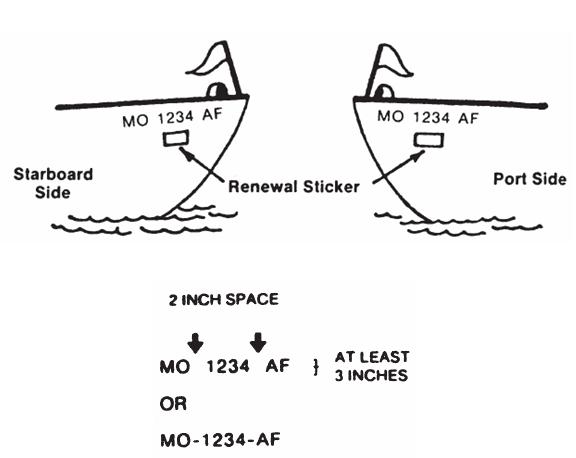

- are permanently affixed on each side of the forward half of the vessel;

- usually remain assigned to the same vessel when ownership transfers, except in certain situations; and

- consist of two alpha characters followed by four numeric characters and two more alpha characters, example: MO 1234 AB.

The registration number assigned to a boat/vessel shall be attached to each side of the forward half of the boat/vessel in such position as to provide clear legibility. Black or dark numbers should be used on light hulls, and white or light numbers should be used on dark colored hulls, providing a sharp contrast.

The registration numbers shall read from left to right, and shall be in block characters of good proportions, not less than 3 inches in height. The numbers must be divided into parts. The letters, prefix and suffix, shall be separated from the numbers by 2 inch spaces. A hyphen may be used within the 2 inch space.

No number other than the registration number awarded to a boat/vessel or granted reciprocity shall be painted, attached, or otherwise, displayed on either side of the bow of the boat/vessel.

Decals

- Serve same function as the tab on a license plate;

- Are placed below each MO number;

- Are valid for a period of three years; and

- Do not remain with the vessel when ownership transfers.

Outboard Motor Decals

Are placed on a solid part of the metal housing and are valid until a change of ownership occurs.

Pocket Card

- Is the certificate of number issued to a vessel;

- Must be available for inspection at all time while the vessel is in operation;

- Is printed at the same time as the certificate of title; and

- Is printed when the vessel registration is renewed.

"In-Lieu" Boat/Vessel Taxes are based on purchase price and purchase date of the vessel.

Vessels Purchased before July 1, 2003

| Purchase Price | Tax Due |

|---|---|

| $50,000 or less | $650 |

| $50,001 to $100,000 | $1,250 |

| $100,001 to $150,000 | $1,850 |

| $150,000 to $200,000 | $2,450 |

| $200,001 or more | $3,050 |

Vessels Purchased on or after July 1, 2003

| Purchase Price | Tax Due | Purchase Price | Tax Due |

|---|---|---|---|

| $15,000 or less | $500 | $300,001 to $350,000 | $5,500 |

| $15,001 to $30,000 | $650 | $350,001 to $400,000 | $6,000 |

| $30,001 to $50,000 | $1,000 | $400,001 to $450,000 | $6,500 |

| $50,001 to $100,000 | $1,400 | $450,001 to $500,000 | $7,500 |

| $100,001 to $150,000 | $2,000 | $500,001 to $550,000 | $8,500 |

| $150,001 to $200,000 | $3,000 | $550,001 to $650,000 | $9,500 |

| $200,001 to $250,000 | $4,000 | $650,001 to $750,000 | $10,500 |

| $250,001 to $300,000 | $5,000 | $750,001 and above | See note below |

Note: The "in-lieu" boat/vessel tax rate for vessels with a purchase price of $750,001 and above is $10,500 plus an additional $1,500.00 for each $100,000 increment in the purchase price. Example: A vessel with a purchase price of $950,000 would have an "in-lieu" boat/vessel tax of $13,000 ($10,000 + $3,000).