Statutory County Recorders Fund

The statutory county recorders fund was established under Section 59.319, RSMo. In 2001 additional legislation was passed to help fund counties who opt to have a separate office for the Recorder of Deeds and Clerk of the Circuit Court by providing counties that meet certain criteria an annual subsidy. Under 59.042, it is funded by $2.00 of the $5.00 fee on real estate documents recorded. The funds are sent to the Department of Revenue monthly. The annual distribution is generally completed by the end of September based on the collections from July 1 through June 30 of the previous fiscal year.

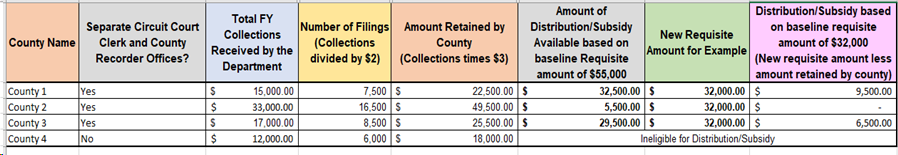

To be eligible for the subsidy and considered a qualified county, the county must have separate county circuit court clerk and county recorder offices at the end of the reporting year (June 30th), and the total amount of the $5.00 fee increase received on recorded instruments under Section 59.800, RSMo, retained by the county ($3.00 per instrument) from July 1 through June 30 reporting year must be less than the requisite amount as determined each year.

The amount disbursed to each county is determined by the number of filings and amount retained by the county.

- Every county submits $2.00 of the $5.00 fee to the Department of Revenue each month.

- The number of filings for each county is determined by taking the total collections divided by $2.

- The amount retained by the county is determined by taking the number of filings times $3.

- The amount of subsidy available is $55,000 (baseline requisite amount) less the Amount Retained by the County. If the total amount for all counties exceeds the average annual collections for the last 3 calendar years, then a new requisite amount must be calculated by the department.

- If a qualified county retains an amount equal to or greater than the requisite amount, they are ineligible for a distribution.

- If the fund balance as of the end of the fiscal year is less than the calculated distribution amount using the baseline requisite amount of $55,000 for all counties, a new requisite amount must be calculated. It is calculated using the fund balance and the average of the last 3 year’s annual disbursement.

Example Distribution Calculation: