Titling and Registration FAQs

General Information

When you purchase a motor vehicle (new or used), you are required to pay the applicable taxes and apply for title in your name within 30 days of the purchase date. This is true regardless of the condition of the vehicle.

If you wish to drive the vehicle, you must also obtain valid registration (license plates).

For complete instructions, visit our Motor Vehicle Titling page.

To prevent unlawful use of your unexpired plates, you may destroy and recycle them where you are, or you may return them to any Missouri license office to be destroyed and recycled.

If you wish to mail them to our central office to be destroyed and recycled, please use the following address:

ATTN: License Plate Surrender

301 West High Street – Rm 370

Jefferson City MO 65105-0100

If you happen to receive a renewal notice for those plates, you may simply disregard the notice.

Unfortunately, Missouri statute does not authorize a refund of registration fees for unexpired plates.

A Transfer on Death (TOD) beneficiary is a simple way to transfer ownership of a vehicle after the titled owner has died. By naming a TOD beneficiary on your title application, you will avoid the need for the vehicle to go through probate upon your death.

If you choose to assign a different TOD beneficiary at a later date, you may do so by completing a new title application. There is no ownership benefit for the TOD beneficiary until the titled owner(s) have died.

Complete and sign an Application for Missouri Title and License (Form 108) (or Application for Duplicate Title (Form 93) for a boat title), pay an $8.50 duplicate title fee and a $9 processing fee. Mark the "Duplicate" checkbox on the form, and indicate the reason you are applying for a duplicate title. The form must be notarized.

The application may be processed at any Missouri license office, or you can mail the notarized application and fee to the following address:

Missouri Department of RevenueMotor Vehicle Bureau

PO Box 100

Jefferson City MO 65105-0100

NOTES:

- If a duplicate title is needed because the original title was mutilated, the mutilated title must be surrendered with the Application for Missouri Title and License.

- If a lien is shown on the original title, you must submit a notarized lien release with your duplicate title application or the duplicate title will include the lienholder information. All titles will be mailed to the owner.

Please visit our Motor Vehicle Licensing Contact Information page.

Under Missouri law (301.130.5, RSMo) most Missouri motor vehicle registrations require two license plates to be displayed on the vehicle (front and rear). The exceptions include motorcycles, vehicles with historic Year of Manufacture registrations, and commercial vehicles registered for 18,000 lbs or greater. However, an applicant registering a commercial vehicle for 18,000 lbs or greater is given the option of obtaining two license plates. If you are issued two plates for your vehicle registration, you must display both plates (front and rear) as required by Missouri law.

You must complete an Application for Missouri Title and License (Form 108) and submit it, with the incorrect title, for a corrected title to be issued. This transaction may be processed at any Missouri license office or by mail through our central office.

Depending on the nature of the error, additional documents and/or fees may be required. If you have additional questions, visit our Ask Motor Vehicle! page.

To obtain a duplicate registration receipt, you must submit a completed, signed, and notarized form Application for Duplicate Title/Registration Receipt (Form 2519) with a check for $17.50 ($8.50 registration + $9.00 processing fee), payable to the Missouri Department of Revenue. You may complete the application at any Missouri license office, or mail the application to our central office using the address on the back of form.

Missouri law requires that a motor vehicle must be titled (within 30 days of the purchase date) before it is either registered for highway use or transferred to another individual. If you do not have a properly assigned title (or Manufacturer's Statement of Origin), you have no clear legal right to the vehicle.

If you did not receive a properly assigned ownership document (e.g., certificate of title) at the time of purchase, and the seller is not available to make proper assignment, you may wish to seek the advice of a legal professional.

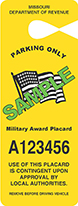

A Military Award Placard is a removable placard which allows a qualified veteran to park their motor vehicle, weighing not more than 6,000 pounds, without charge in a:

- Metered parking space contingent upon approval of local authorities; or

- Parking lot or garage on any public college or university in the state of Missouri, except during a special event where a separate parking fee may apply.

A Military Award Placard may be issued to a veteran if the applicant has been awarded any of the following medals through military service:

- Distinguished Service Cross

- Air Force Cross

- Coast Guard Cross

- Congressional Medal of Honor*

- Former Prisoner Of War*

- Purple Heart*

- Silver Star*

- Navy Cross*

- Distinguished Flying Cross*

- Bronze Star*

- Bronze Star Valor*

* Specialty plate is available for this designation.

To obtain the placard, the applicant must submit:

- A completed and signed Application for Missouri Military Personalized License Plates (Form 4601); and

- The veteran must already have one of the specialty plates listed above, or present award of medal verification. Common documents demonstrating award of medal are:

- Certificate of Release or Discharge from Active Duty (Form DD214);

- Correction to Form DD214 (Form DD215); or

- A citation letter given with the award that states the medal has been received.

There is no fee charged for the placard.

The application may be completed at a local license office or mailed to our central office for processing.

Before using this placard, it is the placard holder’s responsibility to contact local authorities to verify that the Military Award Placard is accepted in that jurisdiction.

NOTE: A Bronze Star Placard issued prior to August 28, 2017 will continue to be honored. The placard holder does not need to request a replacement.

You may simply disregard the notice. If you still have the unexpired license plates from the car, and you do not plan to apply for transfer of the plates to another vehicle titled in your name, you may surrender the plates at any Missouri license office, or you may mail the plates (with a note explaining the surrender) to our central office:

Missouri Department of RevenueMotor Vehicle Bureau

301 West High Street – Room 370

Jefferson City MO 65105-0100

You may apply for a new title at any Missouri license office. You must submit the notarized lien release (copy or original), your current title (if in your possession) and pay an $8.50 title fee and a $9 processing fee. The new title (in your name, without the lien) should issue within 3-5 business days, and will then be mailed to you (at the address provided on the application).

If you would prefer to submit your application by mail (to the address shown below), you must submit the documents and fees listed above, plus a completed and signed Application for Missouri Title and License (Form 108). Your signature on the Form 108 must be notarized if you are not in possession of your current title. The average turnaround time for a mail-in title application to be processed is 4-6 weeks.

Missouri Department of RevenueMotor Vehicle Bureau

301 West High Street – Room 370

Jefferson City MO 65105-0100

NOTE: You should keep the original notarized lien release (or a copy) for your personal records. The copy that is submitted with your application will not be returned to you.

Vehicle Renewals

You may renew your vehicle registration (license plates) with the online system, if a Personal Identification Number (PIN) is recorded on your renewal notice. Click HERE to Renew your plates online!

Information regarding the required documents and fees can be found on the Renewing Missouri License Plates page of our website.

If you did not receive your registration renewal notice, you may renew by mail or at any Missouri license office.For more information about the required documents and fees, visit our Renewing Missouri License Plates page.

NOTE: Even if you do not receive a computer-generated renewal notice from the Motor Vehicle Bureau, you are still responsible for renewing your license plates before they expire. There is a $5 late renewal penalty if you fail to renew by the last day of the month of expiration.

There are two guidelines for obtaining a two-year registration:

- Any motor vehicle manufactured as an even model year vehicle may obtain a two-year registration which will expire in an even-numbered calendar year.

- Any vehicle manufactured as an odd model year vehicle may obtain a two-year registration that will expire in an odd-numbered calendar year.

Fees

A chart of motor vehicle registration fees can be found on the Motor Vehicle Fees page of our website.

- You must pay the state sales tax and any local taxes of the city or county where you live (not where you purchased the vehicle). The state sales tax rate is 4.225 percent and is based on the net purchase price of your vehicle (i.e., the price after any rebate or trade-in). Use the tax calculator to estimate the amount of tax you will pay when you title and register your new vehicle.

- If you bought your vehicle out-of-state and paid taxes on the vehicle to that state, that tax will be credited toward the amount of tax due in Missouri. You must provide proof of the amount of tax you paid in the other state. If the amount of tax paid in the other state is less than the amount owed in Missouri, you will be assessed the difference. If the vehicle was titled in your name in another state for more than 90 days, no Missouri sales tax will be assessed.

Payment may be made by cash, personal check, or money order at any Missouri license office. Credit and debit cards (Discover, American Express, Master Card, and Visa) are also accepted.

The Department's central office accepts cash, personal check, cashier's check, money order, and credit or debit cards (Discover, American Express, Master Card, and Visa). Personal checks must be made payable to the Missouri Department of Revenue. Personal checks must be preprinted with the check writer's name, address, bank code, and account number. The personal check must also include the following information regarding the check writer:

- Driver license or nondriver ID number

- Date of birth; and

- Daytime phone number.

The Missouri Department of Revenue may electronically resubmit checks returned for insufficient or uncollected funds.

Credit / Debit Card Transactions – The "convenience fee" charged by the credit/debit card vendor is 2.0% + $0.25 per card transaction.

New to Missouri/Address Change

You have 30 days from the date of becoming a Missouri resident to title your vehicle. For complete instructions, visit our Motor Vehicle Titling page.

For information on how to update your address in our files, visit our How Do I Change My Address in Revenue Records? page.

Title Name Changes

In order to change your name on your title, you must bring the current title, a completed Application for Missouri Title and License (Form 108), and proof of your legal name change to any Missouri license office. The fee for the duplicate (adding a name) title is an $8.50 duplicate tile fee, and a $9 processing fee.

If you have not already named a Transfer on Death (TOD) beneficiary on the vehicle title, you should do so at the same time.

Even if no Transfer on Death (TOD) beneficiary was named on the title, a surviving spouse or unmarried minor child may transfer ownership of a vehicle (limited to one vehicle) titled in the deceased owner's name without obtaining a probate order. The surviving spouse or unmarried minor child must obtain title in their name before assigning ownership to a purchaser.

For the purpose of this process, "minor" refers to a child who is under the age of 18.

To apply for title, the surviving spouse or unmarried minor child must submit the following items:

- A completed and signed Application for Missouri Title and License (Form 108) in the name of the surviving spouse or unmarried minor child;

- The certificate of title in the deceased's name, or with the deceased named as purchaser in the title assignment;

- A photocopy of the proof of death (such as a death certificate or obituary);

- A completed, signed and notarized Affidavit to Establish Title to Exempt Property (Form 2305); and

- The $8.50 duplicate title fee and a $9 processing fee.

If the deceased owner of a vehicle had not designated a Transfer on Death (TOD) beneficiary, the vehicle must go through probate before a transfer of ownership can occur.

When applying for a Missouri certificate of title accompanied by Letters of Administration, Letters Testamentary, or a Small Estate Certificate/Affidavit, the following items must be submitted:

- The appropriate application form, completed and signed:

- The certificate of title in the decedent’s name, properly assigned (by the administrator, executor, or personal representative of the estate) to the new owner. If the title is lost, stolen, or mutilated, the administrator, executor, or personal representative named in the court order must apply for:

- A duplicate title in the name of the estate (if one is open) or in the deceased person’s name; or

- An original title in his or her name or by submitting an affidavit for lost title and the court order;

- The original or certified copy of the Letters of Administration Letters Testamentary, or Small Estate Certificate/Affidavit; and

- The appropriate title and processing fees:

- $17.50 (motor vehicle or trailer title)

- $16.50 (boat title)

- $14 (outboard motor title)

The administrator, executor, or personal representative (except a creditor with Letters of Refusal) may give the vehicle as a gift if the decedent paid taxes on the vehicle and a gift affidavit is presented. If the vehicle is transferred as a gift, no sales tax is due.

If the administrator, executor, or personal representative applies for title in their name, no sales tax is due.

Application for title may be made in person at any Missouri license office, or the paperwork and fees can be mailed to our central office for processing:

Missouri Department of RevenueMotor Vehicle Bureau

301 West High Street – Room 370

Jefferson City MO 65105-0100

You must sign and print your name as "seller", and the other person (who is being added) must sign and print their name as "purchaser". Leave the "purchase price" blank because this is not a complete change of ownership.

Either one of you may then apply and pay an $8.50 title fee and a $9 processing fee for a new title in both names. You must complete an Application for Missouri Title and License (Form 108) and submit the application by mail or at any Missouri license office. This is also a good time to add a Transfer on Death (TOD) beneficiary.

Lienholder authorization is required to add or remove a name from a title if an outstanding lien exists. The Notice Of Lien, Lien Release, Or Authorization To Add/Remove Name From Title (Form 4809) should be used.

Your ex must sign and print their name as "seller", and you must sign and print your name as "purchaser". Leave the "purchase price" blank because this is not a complete change of ownership.

If the title has been lost or stolen or you cannot reach your ex, but you were awarded the vehicle in the divorce, the divorce decree may be presented in lieu of the properly assigned title.

You may then apply and pay an $8.50 title fee and a $9 processing fee for a new title in your name alone (or you may add a different co-owner). You must complete an Application for Missouri Title and License (Form 108) and submit the application by mail or at any Missouri license office. This is also a good time to add a Transfer on Death (TOD) beneficiary.

Lienholder authorization is required to add or remove a name from a title if an outstanding lien exists. The Notice Of Lien, Lien Release, Or Authorization To Add/Remove Name From Title (Form 4809) should be used.

The person who's name is being removed must sign and print their name as "seller", and you must sign and print your name as "purchaser". Leave the "purchase price" blank because this is not a complete change of ownership.

Or, if the co-owner is now deceased, proof of death is required (i.e., copy of death certificate, newspaper obituary clipping, funeral home card) with the unassigned title.

You may then apply and pay an $8.50 title fee and a $9 processing fee for a new title in your name alone (or you may add a different co-owner). You must complete an Application for Missouri Title and License (Form 108) and submit the application by mail or at any Missouri license office. This is also a good time to add a Transfer on Death (TOD) beneficiary.

Lienholder authorization is required to add or remove a name from a title if an outstanding lien exists. The Notice Of Lien, Lien Release, Or Authorization To Add/Remove Name From Title (Form 4809) should be used.

Information for Disabled

Submit an Application for Disabled Person Placard (Form 2769), and Physician's Statement for Disabled License Plates or Placards (Form 1776) from your licensed physician, chiropractor, podiatrist, advanced practice registered nurse, or optometrist stating that you qualify for a Disabled Person Placard either by mail to the Motor Vehicle Bureau, PO Box 100, Jefferson City, MO 65105, or in person at any Missouri license office. There is no fee required to obtain a Permanent Disabled Placard.

If you are temporarily disabled, your licensed physician, chiropractor, podiatrist, advanced practice registered nurse, or optometrist can indicate on the Physician's Statement for Disabled License Plates or Placards (Form 1776) that you will need the Disabled Person Placard for a specific length of time not more than 180 days.

Yes. The applicant must present an invoice or other documentation showing the vehicle and equipment price separately in order for the equipment to be exempt. Specifically, 144.030.2(18), RSMo provides an exemption for “items used solely to modify motor vehicles to permit the use of such motor vehicles by individuals with disabilities".

In addition to any other standard registration requirements, you may submit one of the following, either by mail to the Motor Vehicle Bureau, PO Box 100, Jefferson City, MO 65105, or in person at any Missouri license office:

- A Physician's Statement for Disabled License Plates or Placards (Form 1776) from your licensed physician, chiropractor, podiatrist, advanced practice registered nurse, or optometrist stating that you qualify for disabled person plates (or a Statement of Business Need, if the applicant is a not-for-profit group, organization, or entity); or

- A statement signed by the vehicle owner and the disabled person (if the vehicle owner is not the disabled person) indicating vehicle is operated 50% of the time by a disabled person.

NOTE: Renewal applicants or new applicants who are already disabled placard holders and 75 years old or older are exempt from the physician’s statement requirement but must submit proof of their age one time, as outlined in Section V.

Effective August 28, 2018, you must submit a new Physician's Statement for Disabled License Plates or Placards (Form 1776) every eight years when renewing a disabled person placard or plate. The statement must be dated within 90 days of your renewal application date. Disabled veterans and persons 75 years of age or older are not required to submit a new physician’s statement at the time of renewing a disabled person placard or plate.

- If you have previously submitted a physician’s statement in the year:

- 2014, a new physician’s statement is not required until the year 2022;

- 2015, a new physician’s statement is not required until the year 2023;

- 2016, a new physician’s statement is not required until the year 2024;

- 2017, a new physician’s statement is not required until the year 2025; or

- 2018, a new physician’s statement is not required until the year 2026.

- You must continue to renew your disabled person placard every four years, and your disabled person plate every one or two years as applicable, regardless if a physician’s statement is required or not.

Motor Vehicle Refunds and Allowances

When you apply for a title, you must submit a bill of sale or Notice of Sale (Form 5049) for the vehicle that you sold and the purchase (or contract to purchase) and sale dates must be within 180 days of one another. You do not have to purchase a "like" vehicle to qualify for a sales tax allowance.

EXAMPLE: You can buy a car and sell a boat and receive a sales tax allowance for the car, but the two events must occur within 180 days of one another.

The purchaser of a motor vehicle, trailer, vessel (watercraft), or outboard motor may deduct the amount of a total loss claim settlement received from an insurance company plus the owner's deductible from the purchase price of another like unit that is purchased or contracted to purchase after the date of loss but no later than 180 days after the date of the total loss payment. The applicant must present a notarized statement from the insurance company indicating the year, make, and identification number of the “total loss” unit, the date the insurance company pays the settlement, the amount of the insurance settlement, and the amount of the insurance deductible, if applicable. If the insurance agent certifies that the information in the statement is true and accurate, the form does not have to be notarized.

The total loss statement can be in anyone’s name; however, at least one of the owners of the total loss vehicle must be the same on the application for title on the newly acquired vehicle. Example: John and Jane Smith have a vehicle titled in their name that is declared a total loss. Brenda Smith insured the vehicle and receives a certified total loss claim from the insurance company. As long as John or Jane’s name is listed as an owner or co-owner on the new vehicle, the total loss credit in Brenda’s name may be used.

In addition, the owner of a motor vehicle, trailer, vessel (watercraft), or outboard motor, that was replaced because of theft or casualty loss, who does not have insurance coverage on the unit, may receive a tax credit on the fair market value of the unit being replaced. The applicant must present the original or copy of the accident report completed by law enforcement agent showing the year, make, and identification number of the total loss vehicle, and the date of accident or loss accompanied by two appraisals listing the fair market value of the total loss vehicle.

The fair market value of the unit is determined on the pre-wrecked condition of the vehicle based on the Kelly Blue Book, NADA Used Car Guide, Abos Blue Book, or the average of two appraisals from licensed motor vehicle or boat dealers. The fair market value is deducted from the purchase price of the replacement unit. The replacement unit must be purchased or contracted to purchase within 180 days after the date of loss as certified by a law enforcement agency on the accident report.

To receive a tax credit on a total loss vehicle, the vehicle being replaced must be a like unit (e.g., a motor vehicle must be replaced by a motor vehicle, a trailer replaced by a trailer).

NOTE: If you have already paid sales tax on your replacement vehicle you may apply for a refund by sending a completed Motor Vehicle Refund Request Application (Form 426) with all supporting documentation to the Motor Vehicle Bureau , PO Box 87, Jefferson City, MO 65105-0087.

Click here for more information about Form 426.

Missouri law does not allow for a refund of registration fees. However, an owner may apply the unused portion of a registration to a new Missouri registration.

Heavy Weight Trucks

Effective August 28, 2013, the owner of a commercial motor vehicle registered for 18,000 lbs or above may be issued a second license plate for the rear of the vehicle. The second plate will have the same configuration as the initial (front) license plate, but will bear a “2” sticker indicating that it is for the rear of the vehicle.

Effective August 28, 2013, the owner of a commercial motor vehicle registered for 18,000 lbs or above may be issued a second license plate for the rear of the vehicle. The second plate will have the same configuration as the initial (front) license plate, but will bear a “2” sticker indicating that it is for the rear of the vehicle.

If you wish to apply for a second license plate, you must submit:

- Proof of ownership or registration;

- A completed Application for Replacement Plate(s)/Tab(s) (Form 1576); and

- The $17.50 fee.

The transaction may be processed at the time of renewal or at any time during the registration period at any Missouri license office. The second plate will be mailed directly to your address (as specified on the application).

The single-plate provision for truck registrations of 18,000 lbs or greater comes directly from Missouri law:

- Subsection 3 of statute 301.130, RSMo, reads as follows:

"All property-carrying commercial motor vehicles to be registered at a gross weight in excess of twelve thousand pounds . . . shall be registered with the director of revenue . . . or with the state highways and transportation commission . . . but only one license plate shall be issued for each such vehicle."

- Subsection 6 of statute 301.041, RSMo, reads as follows:

"The applicant for registration pursuant to this section shall affix the registration plate issued to the front of the vehicle in accordance with the provisions of section 301.130 . . ."

You may print a copy of each of the above statutes, and keep the copies in the truck for presentation to law enforcement, as needed.

Apportioned plates are issued by the Missouri Department of Transportation (MoDOT). Please visit the Motor Carrier Services page of the MoDOT website.

Other Units

Titling and registration for a scooter or moped depends on whether the vehicle meets the definition of a motorized bicycle. The Missouri statute definition of a motorized bicycle is as follows:

"Any two-wheeled or three-wheeled device having an automatic transmission and a motor with a cylinder capacity of not more than fifty (50) cubic centimeters, which produces less than three (3) gross brake horsepower, and is capable of propelling the device at a maximum speed of not more than thirty (30) miles per hour on level ground."

A motorized bicycle does not have to be registered with the Missouri Department of Revenue. However, you must have a valid driver license to operate a motorized bicycle (though no motorcycle endorsement is required).

Missouri statute does not require a helmet to be worn when operating a motorized bicycle. Please contact your local law enforcement agencies for any county/municipal codes that deal with helmets and motorized bicycles.

Keep in mind that no motorized bicycle may be operated on any public thoroughfare located within this state that has been designated as part of the federal interstate highway system.

Titling and registration requirements for an autocycle/motorcycle/motortricycle are generally the same as for any other motor vehicle, except that all cycles are exempt from emissions inspection.

For more information, visit our main Motor Vehicle Titling & Registration page.

No. Cotton module transporters are exempt from titling and registration and are allowed to operate on dyed fuel.

If you still have questions, please check out our How Do I? section.

Still need help? Visit our Ask Motor Vehicle! page.